NCGA focused on advancing farmer priorities in new legislative landscape

By Brooke S. Appleton, Vice President of Public Policy for the National Corn Growers Association

The Nov. 5 election provided a clearer picture of what the next couple of years will look like in Washington. With an overwhelming majority of the votes counted, we are preparing to swear in President-Elect Donald Trump and a new Republican-controlled Congress in January.

The changes in Washington will be top-down. We will have new leadership at all the federal agencies, including those that oversee important issues for farmers, like the U.S. Department of Agriculture. While nominations for leadership roles are coming in quickly, at this writing, we do not know who will be nominated as secretary of USDA.

With our growers facing tough economic headwinds, NCGA and corn grower leaders are already working hard to shape the coming policy landscape. Our short-term focus is to advance key priorities during the waning weeks of 2024, in which there are fewer than 20 joint legislative days left.

Listed below are our remaining legislative goals for this year.

Passing disaster relief

Passing disaster relief and economic assistance for farmers is important. NCGA is supportive of efforts in Congress to provide relief to growers facing financial hardships, ranging from economic difficulties to natural disasters.

This funding is proposed in addition to and as a bridge to a strengthened farm safety net.

Year-round E15 access

Pushing legislation to allow for year-round consumer access to E15 is another crucial goal. EPA already granted a request from eight Midwestern governors to allow the year-round sale of fuel with a 15 percent ethanol blend, or E15, in their states beginning in 2025.

But there is legislation in Congress that would codify this agreement into law, allowing for year-round consumer access to E15 across the country. We are working to pass this legislation by year’s end. Access to higher blends of ethanol is good for the environment, saves consumers money at the pump and helps expand demand for corn ethanol. Let’s get this done.

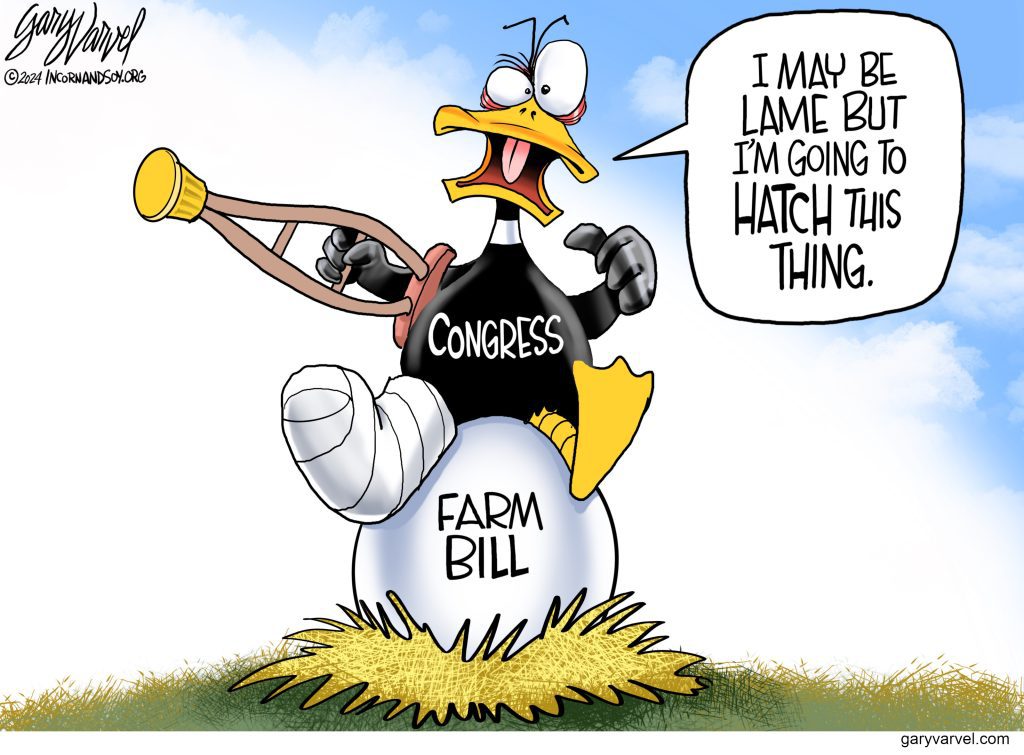

A robust farm bill

There is still a chance we will see a strengthened farm bill passed this year, but it’s a big hill to climb in only a few short weeks of a lame-duck session.

While we are disappointed that there has not been more public progress, we are prepared to continue our advocacy until a bill that reflects corn grower priorities is signed into law.

Turning to the new year and beyond, our advocacy priorities include:

The Next Generation Fuels Act

With farm income on a steady decline, the Next Generation Fuels Act – which would modernize the liquid fuels system – is the best path forward to capture more of the light-duty vehicle market and stimulate demand for corn. That’s why it has been and will continue to be one of our top legislative priorities.

The Next Generation Fuels Act enjoys support from bipartisan members of the House and Senate. But we need additional support from members of Congress. Transitioning the gasoline supply to lower carbon, high-octane fuel – something higher blends of ethanol can provide – reduces emissions and increases vehicle fuel efficiency. Advancing this legislation will be a priority in the year ahead.

New foreign markets for corn

International trade is an important demand driver for U.S. corn, as roughly 15 percent of the U.S. corn crop is exported. NCGA continues to advocate for proactive trade negotiations that open new markets to U.S. corn.

This includes reducing tariff and non-tariff barriers that could impede access to foreign markets. We look forward to working with the new administration to pursue trade agreements or other initiatives that address market access. NCGA will continue to call on Congress to increase funding in the farm bill to open new markets for U.S. agriculture products.

Sustainable aviation fuel tax credits

The Inflation Reduction Act, passed in 2022, provided tax credits for biofuel producers looking to make inroads into the aviation sector. To access the tax credits, producers must meet certain emission reduction standards. Unfortunately, the Biden administration has released a set of practice standards that growers must use for corn to qualify as a feedstock for SAF.

The bundling of these practices does not work for most of the country’s 90 million acres of corn. We look forward to working with the Trump administration to preserve this tax credit while making the requirements for accessing it more realistic.

We certainly have our work cut out for us over the coming weeks, months and years. But I am confident that we will move the needle for growers. To hear my analysis of the election and its aftermath, listen to the latest episode of NCGA’s Cobcast.

Here’s to November. Here’s to democracy. Here’s to a new legislative landscape!

Posted: November 16, 2024

Category: ICGA, Indiana Corn and Soybean Post - November 2024, News