ASA State Policy Communications Coordinator

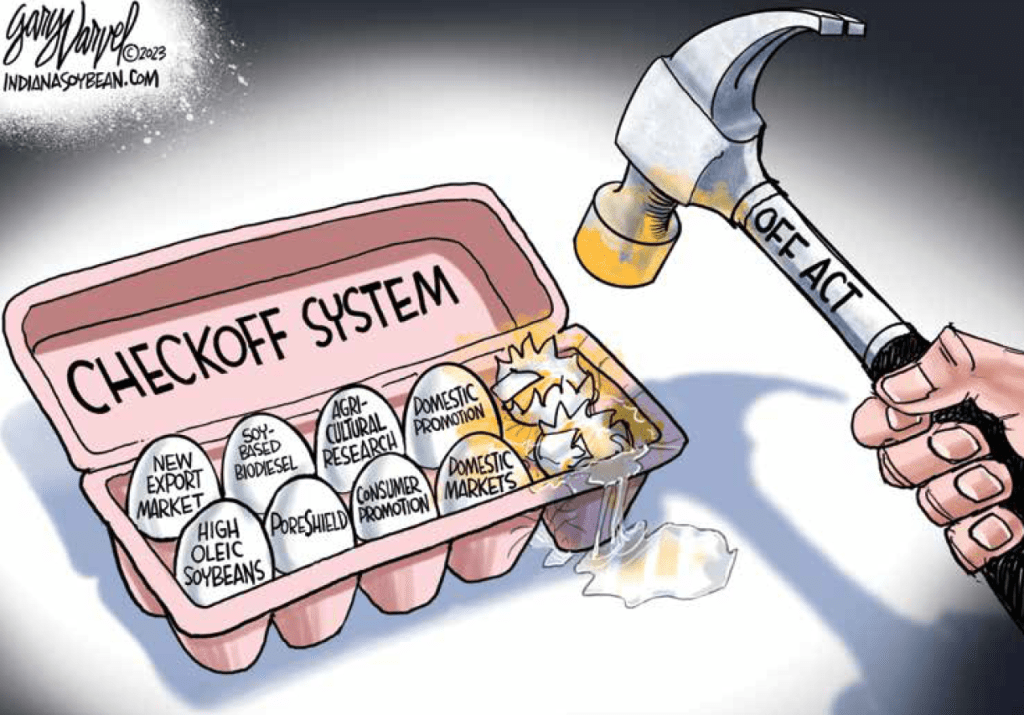

February, a bipartisan group of legislators from both chambers reintroduced the Opportunities for Fairness in Farming (OFF) Act. This proposed legislation aims to reform checkoff boards by prohibiting checkoffs, also referred

to as research and promotion programs, from contracting with an organization that engages in lobbying, conflicts of interest, or anticompetitive activities that harm other commodities.

This bill would also require that checkoffs publish all budgets and disbursements of funds for the purposes of public inspection and submit to periodic audits by the USDA Inspector General. This would prevent the American Soybean Association and the U.S. Soybean Board/Our Soy Checkoff (USB) from working together on behalf of U.S. soybean farmers.

However, the strict compliance that the soy checkoff follows dispels the claims made by supporters of the OFF Act, as USB is prohibited from using resources to influence public policy. Funds collected or received by USB cannot be used in any manner for the purpose of influencing legislation or any policy or action of the U.S. government, any foreign or state government, or any political subdivision of those entities. With no public tax dollars involved, USB and its work are funded entirely through soybean checkoff assessments collected from farmers.

ASA strongly opposes this legislation and has been working with leadership in both the House and Senate to educate congressional leaders on the countless benefits checkoff programs bring to farmers. Soybean checkoff programs allow soybean farmers to invest in programs that enhance markets and the overall value of soybeans.

Producer checkoff programs are a valuable tool in building new demand and educating on issues that threaten

the future of farming. For every dollar farmers invest in the soy checkoff, they receive a $12.34 return on investment through the results of USB promotion, research and education.

Every year, checkoff-supported research helps bring dozens of new soy products to market. U.S. companies now offer approximately 1,000 soy biobased products.

Due in part to research funded by the soy checkoff, the Goodyear® Tire & Rubber Company introduced tires featuring soybean oil in 2021. Goodyear has a stated goal of eliminating its dependence on petroleumbased oil by the year 2040, which bodes well for the future of this market. Building on this success, Skechers running shoes now use the same rubber technology found in Goodyear tires.

In April, ASA along with other major ag associations, submitted comments to lawmakers opposing the OFF Act while explaining the numerous benefits checkoffs provide to farmers.

In the letter to leaders of both the House and Senate Agriculture Committees, the groups maintain the OFF Act, “would set producers back decades in the work which has been done to promote our commodities and improve

the businesses and livelihoods of our members. Checkoff programs have made significant, measurable strides raising the level of demand for each of our respective products. Without these programs, demand and education outreach efforts would be adversely impacted to an immense degree.”

Limit, Save, Grow Act of 2023

On April 26, the House passed the Limit, Save, Grow Act of 2023, legislation to increase the debt limit through the spring of 2024, by a narrow vote of 217-215 after days of tense negotiations. The bill will now move to the Senate, where it is not expected to pass in its current form if brought up for a vote.

ASA continues to support Congress and the administration identifying a bipartisan solution that will prevent a debt default and hopes that this vote will help jumpstart formal negotiations.

After hours of closed-door negotiations with biofuels champions, Republican leadership agreed to make significant changes to the biofuels tax credit repeals originally included in this debt limit bill. Of note, the repeal of the Biodiesel Tax Credit (BTC) extension has been removed from the legislation. That means the extension of the BTC through 2024, as included in the Inflation Reduction Act (IRA), would remain in effect. Other tax credits important to the ethanol industry, including the Carbon Oxide Sequestration Credit and the Second-Generation Biofuel Credit, also have been saved from the chopping block.

The new tax credit programs created under the IRA are a bit more complicated. The amended legislation would allow biofuel producers that have already entered into written contracts or made significant investments based on future tax credits between Aug. 26, 2022, and April 19, 2023, to participate in the Sustainable Aviation Fuel Tax Credit and Clean Fuel Production Credit created through the IRA.

However, for all other producers, these tax credits would no longer be available if this bill were to become law. While these provisions provide some relief, prohibiting future utilization of these credits would prohibit additional growth in the industry.

President Biden is continuing to threaten a veto if this package were to pass the Senate.

Rather than endorsing or opposing the House package, ASA continues to support Congress and the Administration identifying a bipartisan solution that will prevent a debt default. We will continue to track any developments that may relate to biofuels tax policy.